Should I wait? Or Should I Buy?

A Clear and Supportive Guide for Homebuyers

Buying a home is a major life and financial decision. When the market feels uncertain or when personal life feels busy, many buyers wonder if waiting might be safer. This guide gives you a clear, calm look at both sides so you can make a confident long-term decision.

1: Why Many Buyers Consider Waiting

People delay buying for different reasons.

- Some worry about the market.

- Some are busy with holidays.

- Some wait because of news or interest rates.

- The feeling is normal. Nobody wants to make a mistake. This guide helps you look at the full picture so your decision is strategic and calm.

2: The Truth About Timing

No expert can predict the perfect moment to buy. Real estate moves based on interest rates, supply, demand, inflation, economic news and local factors.

Trying to time the market often means missing years of equity, stability and tax advantages.

3: The Hidden Cost of Waiting

Delaying often feels neutral, but it has real financial and lifestyle consequences. Every month you wait:

- You lose a month of building equity

- You lose a month of paying down your own loan instead of a landlord’s

- You stay exposed to rent increases

- Inflation continues to reduce your buying power

- You postpone stability and long term wealth building

- Delays usually cost time, money and opportunity.

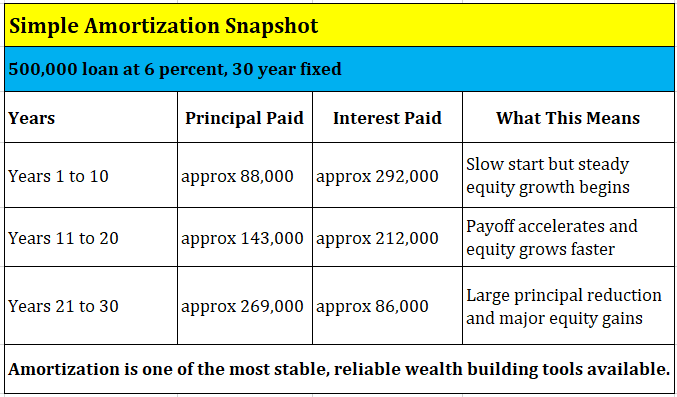

A home loan is structured so that early payments focus more on interest, but every year, more of your payment goes toward principal. After the first few years, principal paydown grows faster. This means:

- In year one, you pay down a small amount of the loan.

- By year five you are paying down more principal each month.

- By years ten and beyond, the principal reduction becomes significant, increasing your equity faster.

The IRS allows many homeowners to deduct mortgage interest and property taxes if they itemize deductions. These deductions can lower taxable income and reduce the overall tax burden. For many buyers, this makes owning more financially efficient than renting.

- Mortgage interest deduction: Homeowners may deduct the interest paid on qualifying home loans, within IRS limits.

- Property tax deduction: Homeowners may deduct state and local property taxes, within IRS limits.

- Ability to itemize when savings exceed the standard deduction.

- These benefits are not available to renters and can reduce your total tax burden.

- Owning a home often enables taxpayers to file with itemized deductions rather than the standard deduction, which can increase overall tax savings.

Tax Disclaimer

This information is for general education only and not tax advice. Buyers should consult with a qualified tax professional or CPA for guidance regarding their specific situation and IRS regulations.

6: Understanding The Power of Ownership Vs Renting

When you rent:

- Your payment builds someone else’s equity.

- You cannot customize your living space.

- Your rent can increase at any renewal.

When you own:

- You build equity through principal paydown.

- You benefit from potential home appreciation over time.

- You lock in stable monthly payments.

- You have full freedom to customize your home.

7: Lifestyle Advantages of Owning a Home

A home is more than an investment. It is a place where you can fully express your identity.

- You can decorate, upgrade and personalize your space without restrictions.

- Children often benefit from the stability and sense of belonging that ownership provides.

- Your home becomes a reflection of your personality, values and lifestyle rather than the rules of a landlord.

This sense of control and stability often leads to a better overall quality of life.

8: A smart way to look at today's market

The more helpful question is not “Are prices at the lowest point,” but:

- “Will owning now make me stronger financially in five years?”

- “Will I benefit from stable payments and long term equity?”

- “Does ownership support my lifestyle, stability and future goals?”

Most buyers find that the long term benefits far outweigh short term market fluctuations.

9: You do not need the lowest price to win

You win by:

- Building equity month after month.

- Reducing your loan balance through amortization.

- Enjoying tax benefits available only to homeowners.

- Living in a home you can fully customize.

- Allowing appreciation and inflation to work in your favor over time.

10: A supportive message for Buyers

Buying a home is not about pressure. It is about building a stable and prosperous future. You deserve clarity and confidence. If you decide to move forward, the goal is to help you do it safely and wisely. If you prefer to wait, that is fine too. What matters is that your decision supports the life and future you want.

Your home is more than a purchase. It is a foundation for your financial stability, your lifestyle and your long term confidence.

Choose Wisely, Reap the Rewards

Homeownership is one of life’s greatest privileges, but working with the right agent is the key to making it smooth, successful, and even enjoyable. Don’t settle for less. Whether you’re buying, selling, or investing, give yourself the chance to work with a true professional.

GoWpNow and The Warburton Team help hundreds of buyers get home every year. We look forward to representing your best interests as a buyer, and we appreciate the opportunity to be of service.

Categories

- All Blogs (60)

- Buyers (31)

- Buying a Home in California (26)

- California--Arizona-or-Nevada (2)

- Careers With The Warburton Team (1)

- Closing Costs (4)

- Communities and Neighborhoods (4)

- Foreclosure Properties in Southern California (2)

- Holidays (2)

- Home Buying Knowledge (14)

- Importance of Real Estate Agents (1)

- Mortgage (3)

- Resources For Buyers (7)

- Selling a Home in California (4)

Recent Posts