Can You Really Lower Your Mortgage Rate by 1–2%? Here’s How a Permanent Buydown Works

If you’re a homebuyer today, you already know the challenge: interest rates aren’t what they were a few years ago. A 30-year fixed mortgage at 6.5% can make monthly payments feel heavy, especially on larger loan amounts. But here’s the good news: if you have some extra cash, you may be able to permanently buy down your mortgage rate by 1%—or even 2%.

What’s a Permanent Buydown?

A permanent buydown is a one-time upfront payment you make at closing to reduce your mortgage interest rate for the life of the loan. Think of it as prepaying interest in exchange for locking in a lower rate forever.

The cost is measured in “points”:

1 point = 1% of your loan amount

In most cases, each point lowers your rate by about 0.25%. So:

4 points (≈ $24,000 approx) can reduce your rate by roughly 1% (e.g. from 6.5% → 5.5%)

What Does That Mean for Your Monthly Payment?

Let’s use that $600,000 example:

• At 6.5%, your principal & interest is about $3,792/month.

• At 5.5%, it drops to about $3,407/month.

• That’s $385 in monthly savings.

Now here’s the kicker: if you spent $24,000 upfront for the 1% rate drop, you’d recoup that cost in about 5 years. After that, all the savings are pure financial wins.

Why It Works Long-Term

A lot of buyers overlook this option because it feels like a big upfront check. But if you know you’re going to stay in the home (and not refinance or sell within a couple years), a permanent buydown can be one of the smartest moves you make:

Your payment is permanently lower.

You shield yourself from future rate fluctuations.

Over decades, the savings compound into hundreds of thousands.

Important: Every Lender Prices Differently

Here’s the part you need to remember: the exact cost of points and the rate reduction they buy varies between lenders and even between loan products. Some lenders may offer more bang for your buck; others less. That’s why you’ll need to consult with a lender to get the actual numbers for your specific loan.

If you’ve got extra cash—whether from savings, family help, or selling a previous property—a permanent buydown is worth exploring. It’s a way to make your mortgage not only affordable today, but manageable for years to come.

Instead of stretching your budget every month, you can put money upfront to buy financial breathing room. For many buyers, especially in higher-cost markets, this strategy can make the difference between feeling squeezed and feeling secure.

Choose Wisely, Reap the Rewards

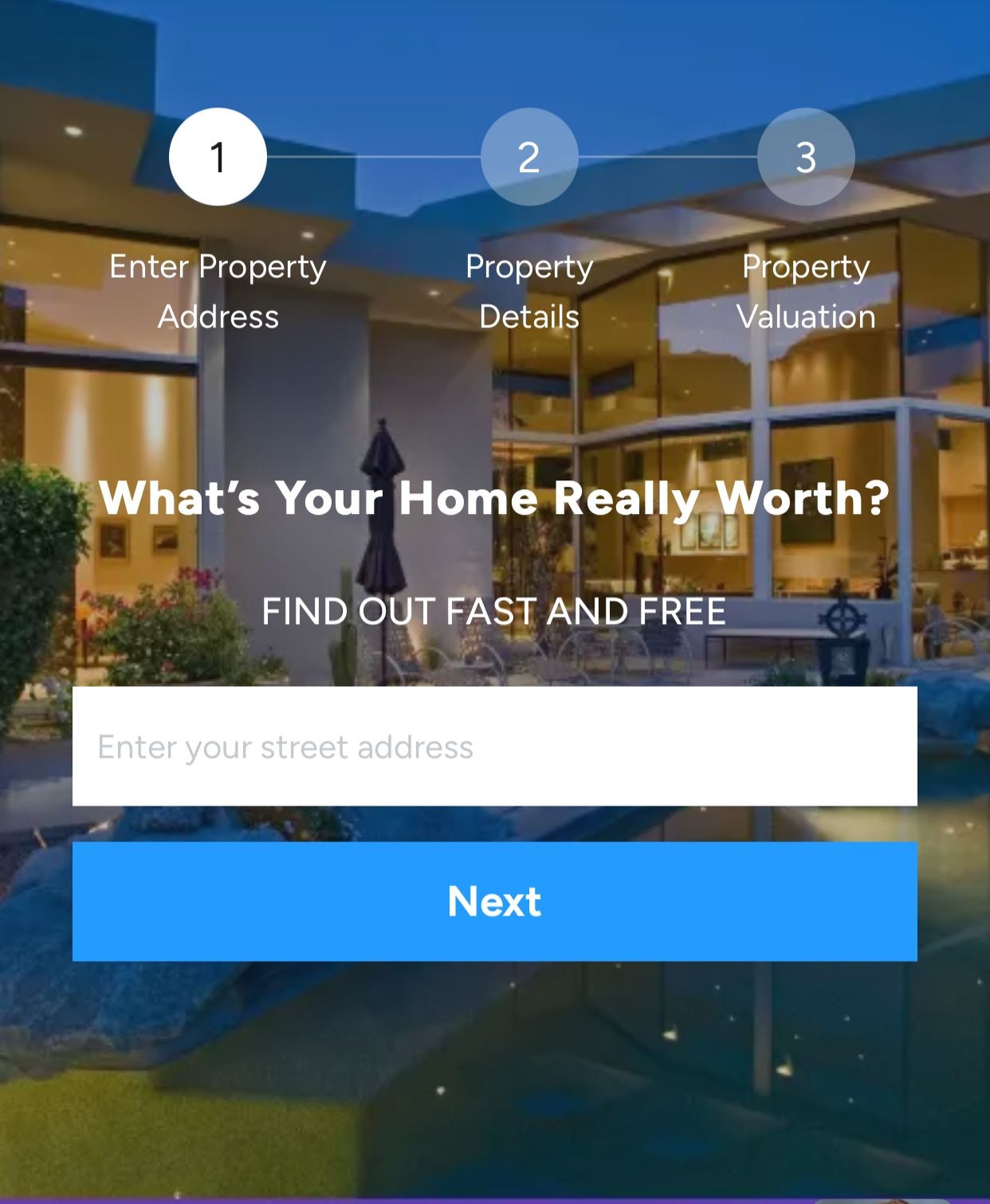

Homeownership is one of life’s greatest privileges, but working with the right agent is the key to making it smooth, successful, and even enjoyable. Don’t settle for less. Whether you’re buying, selling, or investing, give yourself the chance to work with a true professional.

GoWpNow and The Warburton Team help hundreds of buyers get home every year. We look forward to representing your best interests as a buyer, and we appreciate the opportunity to be of service.

Categories

- All Blogs (55)

- Buyers (29)

- Buying a Home in California (25)

- California--Arizona-or-Nevada (1)

- Careers With The Warburton Team (1)

- Closing Costs (4)

- Communities and Neighborhoods (4)

- Foreclosure Properties in Southern California (2)

- Holidays (2)

- Home Buying Knowledge (13)

- Importance of Real Estate Agents (1)

- Mortgage (3)

- Resources For Buyers (7)

- Selling a Home in California (2)

Recent Posts